Lease rentals are a committed cost which cannot be avoided by withdrawing from this order which is why they should be ignored for the purpose of this analysis. This represents the share of lease rentals of the factory plant for the number of days in which production for the order will take place. This represents the manufacturing equipment’s depreciation for the number of days in which production for the order will take place.

Example of relevant cost of material

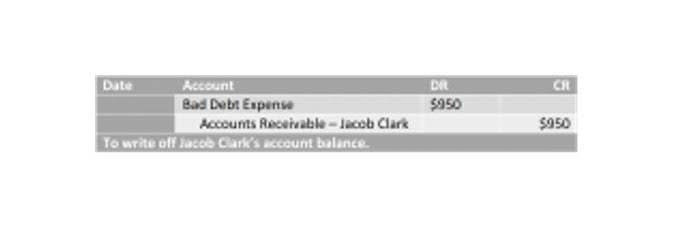

- Sunk CostSunk cost is expenditure which has already been incurred in the past.

- Moreover, Flowspace offers an in-depth product inventory management system, granting brands full transparency over their stock.

- If the scatter graph reveals a linear cost behavior, then managers can proceed with a more sophisticated analyses to separate mixed costs into their fixed and variable components.

- Additionally, businesses can negotiate volume discounts with suppliers, reducing variable costs per unit.

- Understanding incremental costs can help a company improve its efficiency and save money.

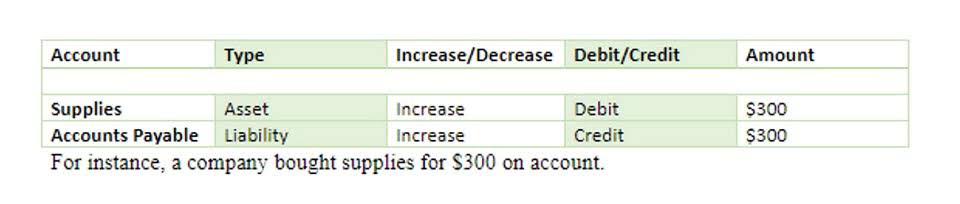

- The concept of relevant cost is used to eliminate unnecessary data that could complicate the decision-making process.

Production volume – this can increase by 50% because currently each item takes 0.5 hours in Operation 2, but 0.25 hours per unit will be released by Operation 1 which now will not be needed. Material – if the buy-in option is accepted, the material cost increases from $12 to $15 per unit. For example, if a company has two year lease for piece of machinery, that cost will not be relevant to a decision on whether to use that machinery on a new project which will last for the next month. Led by Mohammad Ali (15+ years in inventory management software), the Cash Flow Inventory Content Team empowers SMBs with clear financial strategies.

- The contribution margin can be calculated by subtracting the total variable costs of production from total sales.

- The cost effects relate to both changes in variable costs and changes in total fixed costs.

- An outsourcing decision arises when the company considers buying a component from a third-party supplier, even if it can make it internally.

- In all three examples, managers used cost data they have collected to forecast future costs at various activity levels.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Evaluating Business Efficiency

Regent’s scatter graph shows a positive relationship between flight hours and maintenance costs because, as flight hours increase, maintenance costs also increase. This is referred to as a positive linear relationship or a linear cost behavior. Standard costing involves estimating the costs of producing a unit based on predetermined standards. These standards are established by analyzing historical data, industry benchmarks, and other relevant factors. By comparing the actual costs incurred during production to the standard costs, businesses can assess their cost per unit and identify any variances.

Example of Incremental Cost

On the other hand, carrying costs, which are variable or semi-variable in nature, tend to change nearly in direct proportion to the level of stock carried in a manufacturing firm. In the above example, reduction in the resale value due to wear and tear will occur independently of the trip, so that is not a relevant cost. The yearly cost of auto insurance is also something that must be paid regardless of what occurs on the trip. However, if an accident occurs on the trip, this may result in an increase in the future cost of the auto insurance, and therefore the extra money above what is normally paid is a relevant cost. D is demand (units, often annual), S is ordering cost (per purchase order), and H is carrying cost per unit. Moreover, Flowspace offers an in-depth product inventory management system, granting brands full transparency over their stock.

- We always choose the highest and lowest activity and the costs that correspond with those levels of activity, even if they are not the highest and lowest costs.

- For example, a furniture manufacturer is considering an outside vendor to assemble and stain wood cabinets, which would then be finished in-house by adding handles and other details.

- For example, if they must hire a second supervisor in order to produce 12,000 units, they must go back and adjust the total fixed costs used in the equation.

- It also helps a firm decide whether to manufacture a good or purchase it elsewhere.

For example, the famous chocolate candy brand M&M’s offers “party favors” to customers who want personalized M&M candies with their names printed on them. This type of order can be a special order since it’s not part of M&M’s regular product line. Therefore, the closure of Production Line B is not a good idea as the revenue lost is greater than the value of the costs saved. Short relevant cost per unit formula multiple-choice tests, you may evaluate your comprehension of Inventory Management. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

The contribution margin is part of the formula used to determine the breakeven point of sales. By dividing the total fixed costs by the contribution margin ratio, the breakeven point of sales—in terms of total dollars—may be calculated. Where Y is the total mixed cost, a is the fixed cost, b is the variable cost per unit, and x is the level of activity. By understanding the factors that affect cost per unit, businesses can make informed decisions about how to produce their products in a way that minimizes costs and maximizes profits.

Variable Costs: Definition and Examples

We translate complex financial concepts into clear, actionable strategies through a rigorous editorial process. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

It is necessary to minimize total inventory costs, and the EOQ concept is ideal in helping to achieve this. Specifically, the EOQ formula shown in the next section should be applied. The Economic Order Quantity (EOQ) is the specific total order amount for a firm’s inventory that minimizes the total cost of inventory management.

How do we calculate the EOQ when there is a specific order cost?

Using a scatter graph to determine if this linear relationship exists is an essential first step in cost behavior analysis. If the scatter graph reveals a linear cost behavior, then managers can proceed with a more sophisticated analyses to separate mixed costs into their fixed and variable components. However, if this linear relationship is not present, then other methods of analysis are not appropriate. Let’s examine the cost data from Regent Airline using the high-low method.